Akustikgitarre für Anfänger von Thomann + Zubehör in Bayern - Bad Staffelstein | Musikinstrumente und Zubehör gebraucht kaufen | eBay Kleinanzeigen

E-Gitarre Harley Benton CST-24T Ocean Flame - Thomann Bundle in Bergedorf - Hamburg Lohbrügge | Musikinstrumente und Zubehör gebraucht kaufen | eBay Kleinanzeigen ist jetzt Kleinanzeigen

1x Gitarren Halterung Gitarrenwandhalter in Hessen - Wiesbaden | Musikinstrumente und Zubehör gebraucht kaufen | eBay Kleinanzeigen ist jetzt Kleinanzeigen

E-Gitarre Harley Benton CST-24T Ocean Flame - Thomann Bundle in Bergedorf - Hamburg Lohbrügge | Musikinstrumente und Zubehör gebraucht kaufen | eBay Kleinanzeigen ist jetzt Kleinanzeigen

1x Gitarren Halterung Gitarrenwandhalter in Hessen - Wiesbaden | Musikinstrumente und Zubehör gebraucht kaufen | eBay Kleinanzeigen ist jetzt Kleinanzeigen

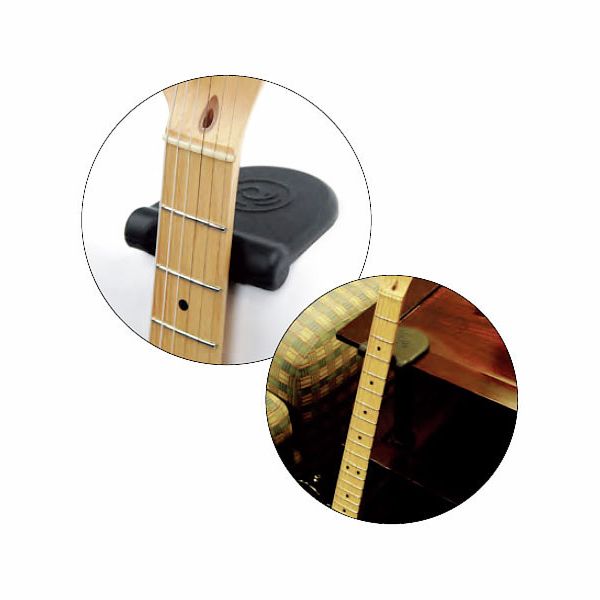

![Zubehör] K&M Gitarrenhalter 16220 Guitar Holder | Musiker-Board Zubehör] K&M Gitarrenhalter 16220 Guitar Holder | Musiker-Board](https://www.musiker-board.de/proxy.php?image=https%3A%2F%2Fthumbs.static-thomann.de%2Fthumb%2Fbdbmagic%2Fpics%2Fprod%2F281297.jpg&hash=bd04172de50b4980d316927d1811f779)